Taking care of household finances can be time consuming and boring – and often people don’t know where to start. Your local library may have some good resources if you want to do your own research, but these simple tips are ones every family can use. If you want to get more serious about your household budget, financial goals and planning your family’s financial future, a qualified Financial Adviser can work with you on something much more detailed, tailored and appropriate.

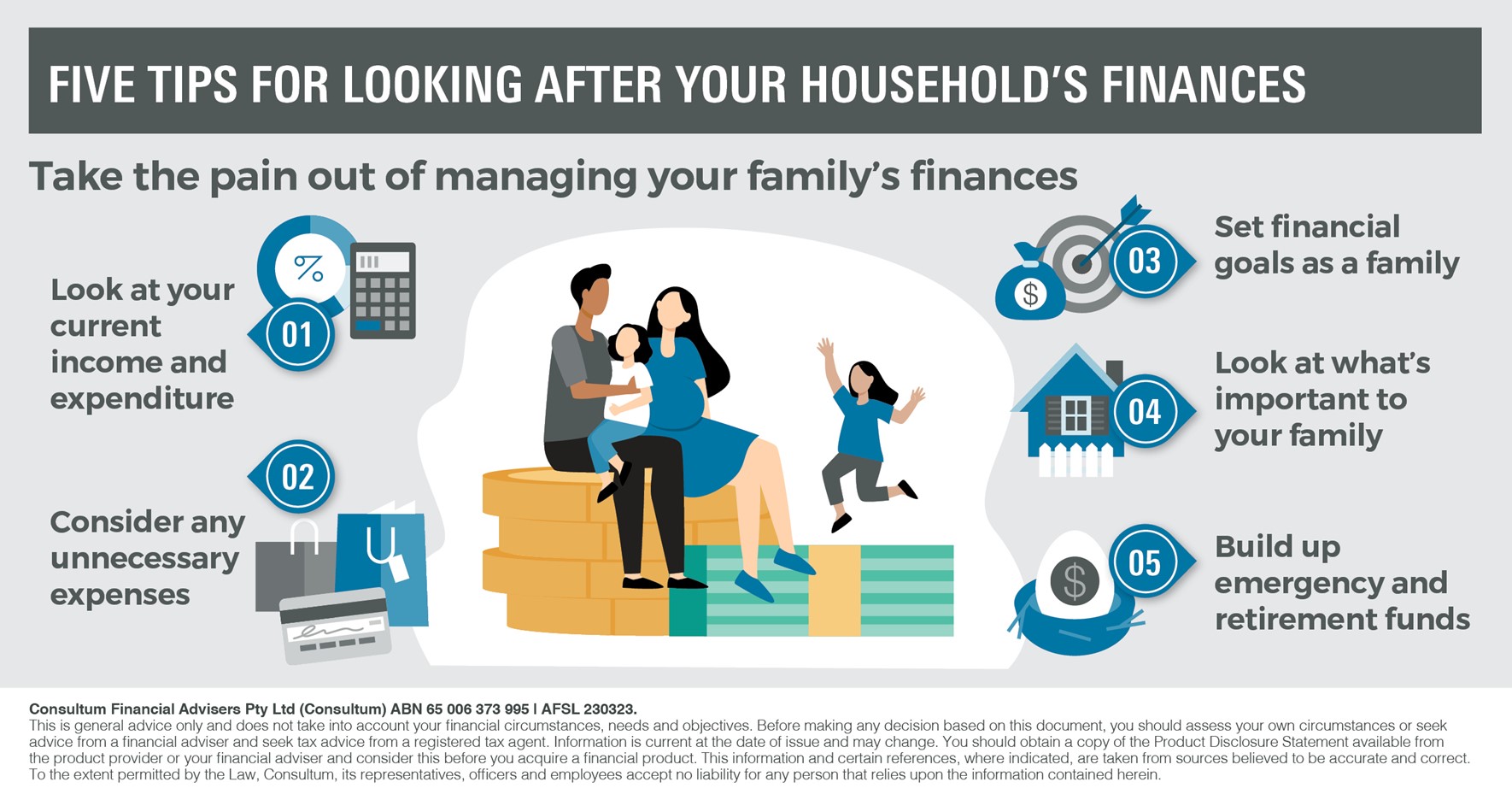

1. Look at your current income and expenditure

Sitting down as a family and figuring out how much money is coming in and going out may help you gauge the state of your family’s finances. A clear picture of your household income and expenses could set you up to manage your cashflow better going forward.

You can make this fun by setting up a spreadsheet or large piece of paper with income and expenses categories you will use to track all expenses and income. You can even highlight different categories in different colours to make it easier to read.

2. Consider any unnecessary expenses

Keeping expenses under control can be tough, especially if you are not used to sticking to a budget. But if you’re spending is as much, or more, than you’re earning, you might want to consider limiting your family’s discretionary costs by buying only what you can afford. If you are tracking expenses on a spreadsheet, it is much easier to see where you may have any unnecessary expenses and cut them out.

3. Set financial goals as a family

Setting financial goals as a family may help you work towards shared aspirations instead of simply meeting current expenses. Whether it’s buying a bigger house, upgrading your car or going on a dream holiday, having a financial goal may help your family set priorities and stay on track financially.

4. Look at what’s important to your family

There are things that will be important to your family, that you should definitely factor into your budget. But there will be other things you can do without. Protecting your family for the long term, through health and illness, is important, so talk to a professional financial adviser about factoring in personal insurance cover that will keep the family protected from unexpected accidents or illness.

5. Build up emergency and retirement funds

Unplanned expenses such as unforeseen medical bills can put a dent in family finances. By growing your emergency fund to cover three to six months’ worth of expenses, you may be better positioned to handle unexpected events.

While it’s easy to neglect your own financial future when providing for your family, saving for retirement should not take second place. Keep in mind that the earlier you start saving, the better chance you have to grow a sufficient nest egg.

Working with a financial adviser

Managing finances need not be a painful exercise. By working alongside a financial adviser and setting financial goals as a family, handling household finances is a task you can achieve. If you are ready to take your budget to the next level with some professional help, we would love to hear from you.

Should you need financial advice speak to the AMA Financial Services team on 1800 262 346 or email advice@amafp.com.au.

AMA Financial Services is an Authorised Representative of Consultum Financial Advisers Pty Ltd | ABN 65 006 373 995 | AFSL 230323

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or seek advice from a financial adviser and seek tax advice from a registered tax agent. Information is current at the date of issue and may change. You should obtain a copy of the Product Disclosure Statement available from the product provider or your financial adviser and consider this before you acquire a financial product. This information and certain references, where indicated, are taken from sources believed to be accurate and correct. To the extent permitted by the Law, Consultum, its representatives, officers and employees accept no liability for any person that relies upon the information contained herein. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.