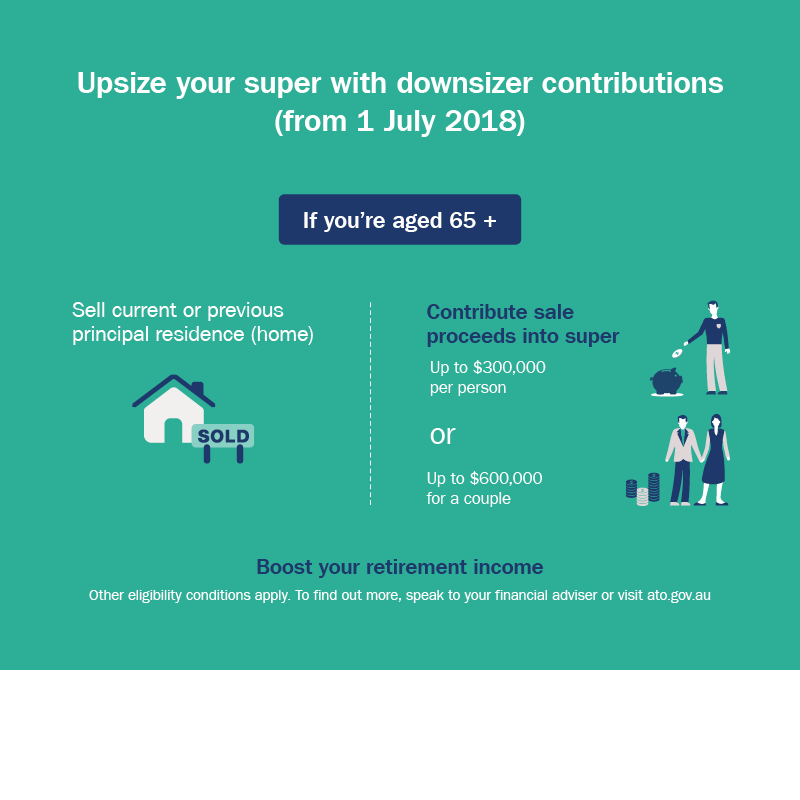

These are known as ‘downsizer contributions’ and they can be made on top of the existing contribution caps, without having to meet certain contribution rules and restrictions.

The opportunity

The downsizer contribution rules remove some of the barriers that prevent or restrict the ability to make super contributions at age 65 or over.

Provided certain other conditions are met (see below) eligible people will be able to contribute up to $300,000 per person (or $600,000 per couple) from the proceeds of selling their home on or after 1 July 2018.

The contributions won’t count towards the concessional (pre-tax) or non-concessional (after-tax) contribution caps and there is no maximum age limit. Also, the ‘work test’ (for people aged 65 to 74) and the ‘total super balance’ test won’t apply.

Key requirements

There are a number of conditions that will need to be met to be eligible to make downsizer contributions, including:

- The individual must be aged 65 or over at the time the contribution is made.

- The property must have been owned by the individual or their spouse (but not necessarily both) for at least 10 years prior to the disposal.

- The contract for sale must be entered into on or after 1 July 2018. The property must qualify for the main residence capital gains tax exemption in whole or part, so properties held purely for investment purposes won’t qualify.

- The contribution must be made within 90 days of the change of ownership.An election needs to be made to treat the contribution as a downsizer contribution.No tax deduction can be claimed for the contribution.

Other conditions may also apply. For more information, please visit the ATO website at www.ato.gov.au

Key considerations

There are some key issues that should be considered when assessing whether making downsizer contributions could be a suitable strategy, including:

- The property being sold to fund the contributions doesn’t have to be the current home. It can be a former home which meets the requirements. Also, a new home doesn’t need to be purchased.

- Once contributed, downsizer contributions will count towards the ‘total super balance’ which could impact capacity to make future contributions.

- Downsizer contributions can’t be transferred into a tax-free ‘retirement phase income stream’ if the ‘transfer balance cap’ has been used up. The transfer balance cap is $1.6 million in 2017/18.

- If the transfer balance cap has already been used up, the contribution must remain in the ‘accumulation phase’ of super, where investment earnings are taxed at a maximum rate of 15%.

- Money held in the accumulation or retirement phase of super is assessed for both social security and aged care purposes.

Could you benefit from downsizer contributions?

If you are thinking about selling your home after 1 July 2018, we can help you decide whether making downsizer super contributions is a suitable strategy for you and assess other options.

Important information and disclaimer

This document has been published by AMA Financial Services, an Authorised Representative of Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 | AFSL 230323.

Any advice in this publication is of a general nature only and has not been tailored to your personal circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance or other decision. Please seek personal advice prior to acting on this information.

While it is believed the information in this publication is accurate and reliable, the accuracy of that information is not guaranteed in any way. Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of the NAB Group, nor their employees or directors give any warranty of accuracy, accept any responsibility for errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.