- US Headline Inflation comes in at 8.3% (vs expected 8.1%)

- US Core Inflation unexpectedly rises to 6.30%

- US Fed expected to raise rates by another 75 basis points next week

- US Markets sell off in the worst day since June 2020

US inflation numbers were released on Tuesday 13th September 2022, and came in higher than expected. While annualised headline inflation fell from 8.5% to 8.3% it was higher than consensus estimates.

Just as important was the reading on core inflation which actually increased from 5.9% to 6.30%. While we have seen falls in gas prices in the US, many of the other components of inflation continue to rise, in particular rents and healthcare. This broadbased increase in prices across the economy gives pause to any narrative that inflation will necessarily return to within the Fed’s 2% target anytime soon, and there remain considerable risks that inflation will be higher for longer than previously expected.

Higher Interest Rates

The Chair for the US Federal Reserve, Jerome Powell, has made two key points in recent weeks. The first is that seeing inflation return to target over time is a priority, and secondly that their future decisions on interest rates will “depend on the totality of the incoming data and the evolving outlook”. With this latest point showing inflation potentially being more stubborn than many may have assumed, it is highly likely the Fed will raise rates again by 75 basis points next week. According to Reuters a strong majority of US economists, 44 of 72, predict the Fed will hike its fed funds rate by 75 basis points next week, compared to only 20% who said so just a month ago. This gives you a sense of the change in outlook this inflation release has caused. If realised this would take the fed funds rate into the 3%–3.25% range.

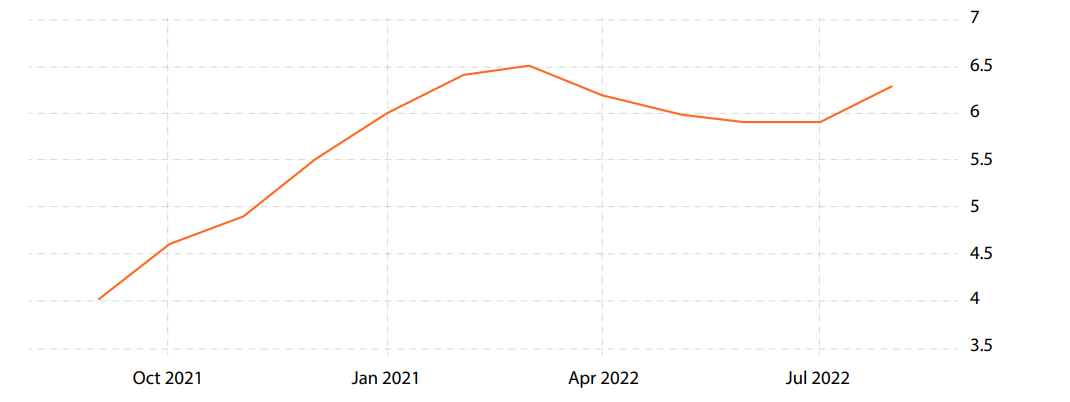

US Core Inflation

TradingEconomics.com | US Bureau of Labor Statistics

Sourced: 14 September 2022

Economic Implications

Ongoing high levels of inflation, combined with the sharp increases in interest rates across the OECD economies that we are seeing, all increase the probability of deep recessions in these countries. In the US the employment market thus far remains resilient, however, many of the other leading indicators when it comes to recessions have been flashing red, including an inversion of the yield curve (shorter term rates are higher than longer term rates) and negative Purchasing Manager Index numbers. Ongoing increases in interest rate rises will put further pressure on the economy, and employment will be the key thing to watch from here.

In the Eurozone there are similar inflation and interest rate dynamics in play, however, the war in Ukraine and greater energy price inflation is putting arguably even greater strain on these economies. The Bank of England has quite forthrightly stated it expects to see a recession in the UK.

Locally, the Australian economy doesn’t currently have quite the intensity of challenges of the US and Europe, but we are nevertheless in the middle of a significant rate hike cycle, and there remains a risk that inflation will prove more stubborn than expected here as well.

Stock Market Reaction

The market reaction has been swift, with valuations hit by the implied increase in discount rates from this inflation print. Furthermore, earnings forecasts look increasingly at risk if there is to be a deeper recession across the OECD. The Dow Jones Industrial Average fell 3.9%, the S&P 500 dropped 4.3%, while the Nasdaq had the biggest fall, down 5.2% in its worst day since March 2020. Locally the ASX is down too, with the ASX 200 down 2.6% as at midday on the 14th September.

In Bond markets, we have also seen losses, albeit more muted than equities with US 2-year treasuries jumping from 3.57% to 3.78% while 10 year US treasuries jumped from 3.35% to 3.43%.

What to do?

This current market volatility, while significant, does not alter our long term views on how portfolios are positioned. Furthermore, when we see a spike in volatility such as we saw on Tuesday, it is often followed by further volatility for several weeks, if not months. Despite being an uncomfortable experience in the short term, we expect equity markets will continue to be an important contributor to overall long-term returns.

It is important to manage your portfolio in line with your longterm objectives, aligned to your risk tolerance and to that end we would encourage you to discuss your portfolio with us.

Get help with investment choices

For financial advice you can depend on speak to the AMA Financial Services team on 1800 262 346 or email advice@amafp.com.au.

This report is prepared by Insignia Financial Research Team, a division of the Insignia Financial Group, consisting of Insignia Financial Limited ABN 49 100 103 722 and its related bodies corporate (Insignia) solely for information only.

Factual information warning

The report contains general economic and market information only. It does not contain or imply any recommendation to buy or sell a security, and is not warranted to be correct, complete or accurate. To the extent that any content is general advice, it may not be appropriate for your circumstances, and you should contact a licensed financial adviser.

This report is current as at the date of issue but may be subject to change or be superseded by future publications.

In some cases, the information has been provided to us by third parties. While it is believed that the information is accurate and reliable, the accuracy of that information is not guaranteed in any way. Past performance is not a reliable indicator of future performance, and it should not be relied on for any investment decision.

Whilst care has been taken in preparing the content, no liability is accepted by any member of the Insignia Financial group, nor their agents or employees for any errors or omissions in this report, and/or losses or liabilities arising from any reliance on this report.

This report is not available for distribution outside Australia and may not be passed on to any third person without the prior written consent of Insignia.